Introduction: Every Screen Is Becoming a Storefront

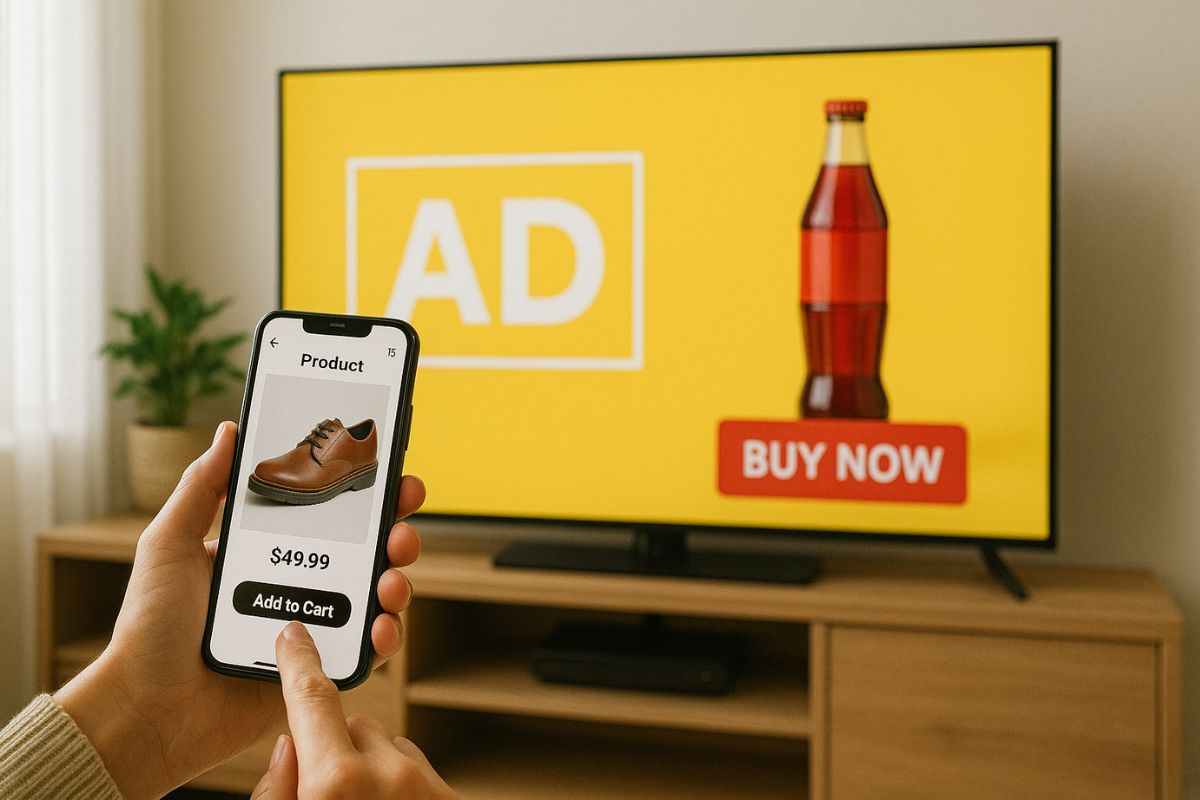

A decade ago, digital ads mostly meant banner placements on websites or short pre-roll videos on YouTube. Fast-forward to today and advertising has migrated to the very moments when we browse for groceries, stream a favorite series, or compare prices on a new smartwatch. For leaders who want to stay ahead of consumer attention, this shift is not a blip. It is a long-term realignment of how, where, and when brands connect with audiences across North America.

In this forward-looking analysis, we unpack the forces moving ad dollars to retail media networks and connected TV, examine the benefits and risks for small and medium businesses, and map out what decision makers should expect through 2026.

1. Streaming and Shopping Sites: The New “Prime” Real Estate

Connected TV is mainstream. More than seven out of ten television minutes in the United States now occur on ad-supported channels, whether traditional broadcast or streaming apps. Platforms that once touted ad-free viewing, such as Netflix and Disney Plus, now offer lower-cost tiers with commercials. The result is a vast, targetable audience that advertisers can reach without the high barriers of traditional prime-time slots.

Retail media is everywhere shoppers click. Scroll Amazon, Walmart, or any large marketplace and sponsored listings dominate the first rows of results. Because these sites record intent signals such as search keywords and purchase history, their ad inventory reaches consumers at one of the most valuable steps in the buying journey: the moment of consideration.

For brands, that dual expansion means the line between awareness and conversion is collapsing. A connected TV spot can spark curiosity during an evening binge. A sponsored product can seal the deal at checkout before the episode is over.

2. Five Forces Driving the Retail Media and CTV Boom

- First-party data is king. Privacy rules and cookie deprecation have made it harder to track users across the open web. Retailers and streaming services own vast troves of authenticated, first-party data that advertisers crave.

- Self-serve ad tools democratize spend. Amazon Ads, Roku OneView, and similar dashboards let marketers start campaigns with minimal budgets, detailed targeting, and real-time optimization.

- Attribution is getting sharper. Closed ecosystems report impressions, clicks, and even in-store sales linked back to ad exposures. That clarity justifies further investment and fuels a virtuous cycle.

- Cord-cutting is accelerating. Households embracing streaming for cost savings accept ad loads that feel lighter than cable’s, yet still deliver reach comparable to linear TV.

- Competition for shopper attention is fierce. As social feeds become overcrowded, brands search for fresh, intent-rich environments where consumers are already in a mindset to spend.

3. Consumer Lens: Relevance, Convenience, and the Fatigue Factor

From the audience perspective, ads inside streaming shows or at checkout feel less intrusive when they align with immediate interests. A viewer watching a travel documentary may welcome a discount on luggage; a shopper browsing trail shoes might appreciate a short video on moisture-wicking socks.

However, relevance can tip into fatigue if frequency caps are ignored or creative quality lags behind user expectations. Brands must balance personalization with novelty, ensuring messages add value rather than noise.

4. SMB Playbook: Winning in a Crowded Feed

Small and medium businesses often hesitate to compete where national brands dominate. Yet retail media networks and CTV offer tactical advantages that can level the playing field.

Start With Clear Objectives

- Awareness campaigns: Use connected TV spots to build brand recognition in specific regions or lifestyle segments.

- Conversion campaigns: Target high-intent keywords on retail platforms to drive direct sales.

Segment and Test Relentlessly

- Launch micro-budgets across multiple audiences, then reallocate spend to the segments that show superior click-through or sales lift.

- Rotate creative assets every two to three weeks to avoid ad fatigue.

Leverage Hybrid Measurement

- Pair platform analytics with third-party tracking pixels to triangulate performance, especially if you sell on and off the major marketplaces.

- Conduct lift studies to understand the halo effect of CTV impressions on branded search traffic.

Collaborate With Inventory Owners

- Negotiate value-add elements such as home-page takeovers, influencer integrations, or access to beta features like shoppable video overlays.

- For physical retailers with their own e-commerce presence, explore co-op spending arrangements with suppliers to stretch budgets further.

5. Big-Picture Implications for Platforms, Regulators, and Investors

Platforms: Expect a land grab for inventory. Streaming services will expand ad-supported tiers, while retailers will roll out new placements ranging from live shopping feeds to voice search in smart assistants.

Regulators: As data collection deepens, privacy watchdogs in Canada and the United States will scrutinize how platforms blend viewer behavior with purchase history. Businesses must prepare for clearer consent rules and possible limits on cross-device tracking.

Investors: The convergence of media and commerce creates new revenue streams but also compresses margins for pure-play publishers. Portfolios should balance tech providers enabling ad measurement with consumer brands agile enough to pivot budgets quickly.

6. Three Predictions Through 2026

- Dynamic creative tied to live inventory. Retail ads will soon display real-time stock levels or delivery windows inside streaming shows, turning a traditional thirty-second spot into a personalized storefront.

- Voice commerce ads in connected households. As smart speakers integrate more deeply with TVs, spoken prompts will invite viewers to add products to carts without lifting a finger.

- Programmatic product placement. Instead of fixed brand cameos, post-production technology will swap digital billboards or coffee cups inside content based on location, time of day, and household demographics.

7. Key Takeaways for Decision Makers

- Follow the audience, not the channel. Whether consumers are watching a crime drama or filling a virtual cart, attention pools where convenience lives. Align spend accordingly.

- Invest in creative diversity. High-quality visuals and storytelling separate value from clutter, especially on big-screen environments where low-resolution assets stand out for the wrong reasons.

- Think omnichannel measurement. The customer journey now jumps from couch to checkout in minutes. Use unified dashboards to trace that path and prevent siloed data from hiding true ROI.

- Plan for regulation by design. Build privacy compliance into data models today to avoid sudden overhauls when new laws take effect.

Conclusion: The Future of Advertising Is Contextual and Commerce-Ready

Retail media and connected TV are no longer experimental add-ons. They form a connected ecosystem where discovery, consideration, and purchase occur within a single scroll or tap. For forward-thinking brands, the mandate is clear: integrate your message into the environments where customers live, shop, and relax. Do it with respect for privacy, a commitment to creative excellence, and a testing mindset that treats every impression as a learning opportunity.

Those who adapt early will capture outsized returns while competitors chase legacy metrics and fragmented audiences. In the new landscape, every screen is a storefront and every moment could be a transaction waiting to happen.